In a blockbuster move that could redefine the entertainment landscape, Netflix has officially agreed to an all-cash deal to acquire Warner Bros. Discovery’s studios and HBO Max business. The transaction, amended from an earlier cash-and-stock proposal to a fully cash-funded offer, values the assets at approximately $82.7 billion in enterprise value (with an equity value of around $72 billion). This development, announced on January 20, 2026, follows months of intense rumors, negotiations, and a heated bidding war that thrust Warner Bros. Discovery (WBD) into the spotlight as one of the most sought-after prizes in media.

The revised agreement simplifies the structure, eliminates stock volatility concerns for WBD shareholders, and accelerates the path to approval. Netflix will pay $27.75 per share in cash for the targeted businesses, a price that remains unchanged from the original terms but now delivered entirely in cash. This shift provides immediate liquidity and certainty, which WBD’s board unanimously endorsed. The deal is expected to proceed after WBD completes its planned separation of the Discovery Global division (including linear networks like CNN, TNT, and Discovery Channel) into a standalone public company, now targeted for the third quarter of 2026. Shareholder approval for the Netflix transaction is anticipated by April 2026.

If finalized, Netflix will gain ownership of Warner Bros.’ storied film and television studios—Warner Bros. Pictures, Warner Bros. Television, DC Studios, and more—along with HBO, HBO Max (the flagship streaming platform), and a vast content library encompassing iconic franchises like Harry Potter, Game of Thrones, DC Comics properties, Friends, The Matrix, and countless others. This acquisition would instantly bolster Netflix’s position as the dominant streaming force, adding premium prestige content, theatrical distribution muscle, and a deep well of intellectual property to its already massive subscriber base.

The deal caps a turbulent period for Warner Bros. Discovery, formed in 2022 from the merger of WarnerMedia and Discovery Inc. Under CEO David Zaslav, WBD grappled with heavy debt, declining linear TV revenues, and intense competition in streaming. HBO Max (later rebranded Max) struggled with integration issues, content strategy shifts, and subscriber churn, while the studios faced box-office volatility and production slowdowns. The separation of Discovery Global was originally part of a broader plan to unlock value, but mounting pressures led WBD to explore full or partial sales.

Netflix’s pursuit began gaining traction in late 2025, with initial talks evolving into a formal offer in December. The original structure included a mix of cash ($23.25 per share) and Netflix stock ($4.50 per share equivalent), but rival interest—particularly from Paramount Skydance, which launched a hostile all-cash bid for the entire WBD entity at a higher valuation—prompted the amendment. Netflix’s all-cash pivot neutralized stock-related risks, strengthened its position, and secured WBD board support as the preferred path forward. Zaslav publicly endorsed the Netflix deal, describing it as a combination of “two of the greatest storytelling companies in the world,” promising enhanced opportunities for creators, consumers, and shareholders.

The strategic implications are profound. For Netflix, the acquisition would provide immediate scale in premium content, a theatrical pipeline to counter declining home-viewing exclusivity trends, and a treasure trove of IP to fuel original productions, spin-offs, and cross-platform synergies. HBO’s prestige brand—home to Emmy-dominating series—would complement Netflix’s volume-driven model, potentially elevating its awards profile and attracting high-end talent. Warner Bros.’ global production infrastructure, including studios in Burbank and Leavesden, would give Netflix physical assets it has long lacked, enabling greater control over filmmaking and post-production.

For the broader industry, this could trigger further consolidation. The deal positions Netflix as an even more formidable competitor to Disney, Amazon, and Apple, while raising antitrust scrutiny from regulators wary of reduced competition in streaming and content creation. WBD’s remaining linear networks, post-separation, would operate independently, potentially facing continued cord-cutting pressures but benefiting from a cleaner balance sheet.

Industry observers view the move as a bold play in an era of uncertainty for traditional media. Streaming wars have intensified, with profitability pressures forcing mergers and asset sales. Netflix’s cash-rich position—bolstered by strong subscriber growth and advertising-tier success—enabled this aggressive step. The all-cash structure also reflects confidence in the combined entity’s future cash flows, as Netflix integrates HBO Max subscribers and leverages Warner’s library for global licensing and originals.

Challenges remain. Integrating two massive content engines could prove complex, with overlapping series, films, and production pipelines. Cultural clashes between Netflix’s data-driven, binge-model approach and HBO’s prestige, auteur-focused ethos might emerge. Regulatory approval could take months or years, with potential conditions or blocks if deemed anti-competitive. Shareholders of both companies must vote, and WBD’s separation timeline adds layers of complexity.

Yet the potential rewards are immense. Netflix would inherit one of Hollywood’s most storied legacies, instantly becoming a hybrid powerhouse of streaming dominance and traditional studio might. For consumers, the merger could mean richer content libraries, more original programming, and innovative crossovers between HBO’s prestige dramas and Netflix’s global hits.

As the entertainment world processes this seismic shift, one thing is clear: if the deal closes, it will rank among the largest media transactions in history, fundamentally altering the competitive landscape. After months of speculation, Netflix’s all-cash commitment signals unwavering intent to claim a dominant future in storytelling. The industry—and audiences—await the next chapters in this unfolding saga.

News

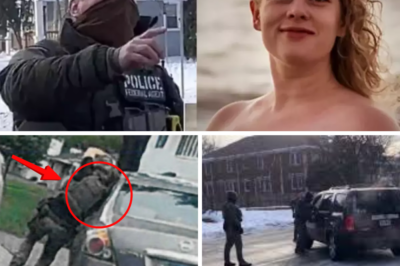

ICE Agent Involved in Fatal Shooting of Renee Good Previously Dragged 300 Feet by Vehicle in Bloomington Incident

Minneapolis, Minnesota – January 20, 2026 — The U.S. Immigration and Customs Enforcement (ICE) agent who fatally shot 37-year-old Renee…

Renee Good’s Family Refuses to Back Down: They’ve Quietly Retained One of America’s Top Attorneys — and Are Now Preparing to Release the Final Audio Recording That Could Change Everything

The family of Renee Nicole Good, the 37-year-old Minneapolis mother fatally shot by a U.S. Immigration and Customs Enforcement (ICE)…

Zion Foster Breaks Social Media Silence with Heartwarming Video of Daughter Story Amid Reports of Split from Jesy Nelson

London, January 20, 2026 — In his first public post since reports emerged of his separation from Jesy Nelson, musician…

Jesy Nelson Confirms Split from Fiancé Zion Foster Amid Heartbreaking Reality of Twins’ SMA Diagnosis

In a development that has left fans reeling, former Little Mix singer Jesy Nelson has confirmed the end of her…

A Teacher Everyone Trusted — Then She Vanished: The Tragic Case of Linda Brown and Lingering Questions After Her Lake Michigan Death

In the tight-knit Bridgeport community of Chicago, Linda Brown was more than just a special education teacher at Robert Healy…

Ex-Husband in Ohio Dentist Murders Allegedly Used Fake Details to ‘Disguise’ Himself Before Killings, Expert Says

Columbus, Ohio – January 20, 2026 — New revelations in the high-profile double murder case involving an Ohio dentist and…

End of content

No more pages to load